There’s a rise in farmers and landowners interested in getting paid for carbon sequestration. Yet in the UK, an absence of robust guidance, protocols and industry experience makes this space feel like the “wild west”. Farmers are at risk of being misled, while NGOs and industry groups are struggling to form clear positions in what’s a fast-moving and confusing landscape.

At the Farm Carbon Toolkit (FCT), we help farmers to measure, understand and act on their greenhouse gas emissions (GHGs). It’s our mission, as a farmer-led organisation, to help farmers become knowledgeable and empowered on this topic, building profitable and resilient businesses that also help to restore our fragile and deteriorating ecosystems. Reducing GHG emissions from farms is a priority and all farmers can begin now.

Therefore we take a close interest in the emerging opportunities for farmers and landowners to access payments for carbon sequestration and storage on their farms. Through our work, we are witnessing more carbon payment opportunities coming through supply chains, grant-funded projects, as well as future options within ELMs and in voluntary carbon offset markets.

With our deep understanding of GHG emissions in agriculture, combined with on-the-ground experience of measuring farm and soil carbon, we are helping to inform various schemes and start-ups. What we witness is mixed. Some schemes are well-designed and robust in their approach to supporting farmers and having impact. While some are less carefully designed, with limited transparency and a possibility of unintended consequences. Farmers, landowners and organisations have limited guidance on best practice and a lack of standards make comparison between schemes challenging.

Context: how a Net Zero paradigm is renewing interest in offsets

As climate breakdown becomes ever more visible, many people and organisations are scrambling to make major cuts in greenhouse gas emissions. In recent years, there has been a proliferation of “net zero” carbon commitments from some of the world’s biggest companies and institutions. To meet these ambitious targets, organisations will need to use every tool at their disposal. This means not only reducing emissions as far as possible, but also investing in activities such as “nature-based solutions” to cover any residual emissions.

Achieving net-zero across society means a gigantic shift in business practice; reinventing business models and shifting the products and services available to citizens. Culturally, industries are in different places on what this means. Some industry leaders are recognising and preparing to implement radical changes, yet can often be working alongside others who are constrained by a tendency towards business-as-usual. What many companies have in common though, is a desire to buy offsets in the short-term to help achieve net zero faster – and many are now turning to farm carbon.

For example, Microsoft recently purchased $500,000 of soil carbon credits from Wilmot Cattle Company, who own an 11,000 acre farm in New South Wales. In the US, various brokers exist to pay farmers for carbon, many using an agreed protocol and a proposed Growing Climate Solutions Act may require the USDA to help farmers access these carbon markets in the future.

Why Offset Schemes Require A Special Scrutiny

There are various ways in which farmers can be supported to shift towards more regenerative agricultural practices. For example, via government subsidies, philanthropic projects, landowner initiatives and through supply chains taking an “insetting” approach. The selling of carbon or biodiversity offsets is another route, coming with a greater need for accurate, trusted measurement and verification.

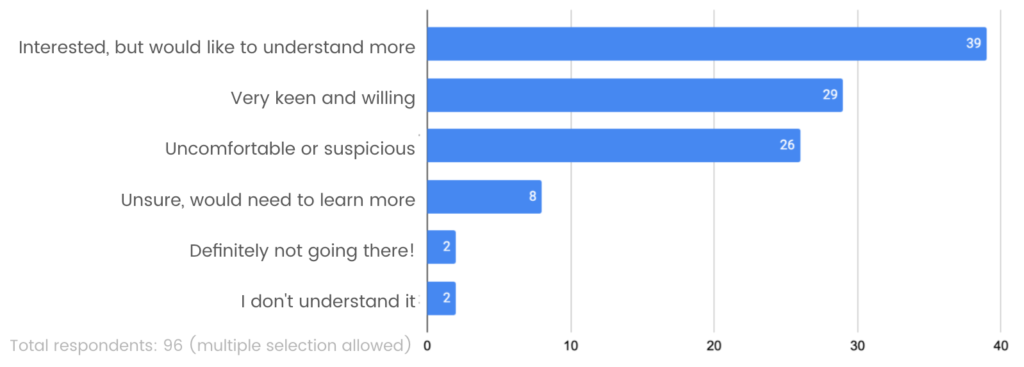

There is currently a lot of excitement around farm and soil carbon offsets in the UK and various new schemes are launching. A recent farmers’ attitude survey we conducted suggested that 30% of farmers are “very keen and willing” to partake in offsetting schemes. Meanwhile, 27% of respondents were uncomfortable and suspicious about this topic.

We urge farmers to recognise the risks that exist around these schemes and ask tough questions to any organisation seeking to “buy” your carbon. To support a more credible and robust environment for farm and soil carbon payments, we are part of a consortium of organisations working towards a UK Farm and Soil Carbon Code.

With carbon offsets – and any other mechanism to support change – there can be risks of driving unintended consequences, especially if we only focus on a narrow goal of carbon reduction. Instead, taking a “food systems” lens to the way we design projects can help us in building a healthier, more socially just food system.

3 Watch-Outs for Farmers Selling Carbon Offsets

To ensure farmers are empowered and clear on the terms in which their whole-farm or soil carbon credits are being sold, we believe farmers should demand the following from organisations seeking to pay them for carbon offsets:

1) What claims can you make in the future about your carbon footprint?

In a carbon offset, the sequestered carbon being sold is effectively taken off the farm or landowners carbon balance sheet and appears on the balance sheet of another business or individual: the “buyer”. This means that the buyer has an exclusive claim to the carbon reductions or removals made by the farm.

What is often overlooked or missing in the marketing materials of offset intermediaries, is that the farm may no longer be able to make claims about any associated produce being “low carbon”. While the farmer may be doing all sorts of positive practices, some or all of their sequestered carbon is on the balance book of the “buyer’ of carbon credits. A farm claiming it is low-carbon could be misleading, amounting to double claiming, propagating a false view of our overall progress against climate change.

For illustration, if all farmers in the UK sold their sequestered carbon via offsets to private companies (that often operate beyond national borders), then the NFU’s Net Zero farming ambition may become impossible to reach, as would the climate pledges of many food retailers and brands who have made Net Zero pledges covering their Scope 3 emissions.

This is a challenge and risk for farmers. Those selling direct-to-consumer may talk about their positive practices but may feel in a tricky position when explaining their carbon credentials, especially if their sequestered carbon has been purchased by an oil or airline company, who are some of the more prominent industry groups currently seeking offsets.

Farmers selling through their supply chains may also be in a weaker position. Retailers are increasingly wanting to buy low-carbon produce and cannot do this if the farm has sold much of it’s sequestered carbon via a private offset. If the farm carbon offset sector follows the recommended principles around double-counting and double-claiming, then farmers may find themselves less desirable to customers.

2) Does the scheme have a transparent, robust methodology on permanence, additionality, measurement and verification?

The credibility of a high quality offset can be tested through its approach to:

- Permanence:

In the ideal offset project, reversals of carbon emissions are physically impossible or extremely unlikely. Standard convention in offset markets has been to guarantee that carbon is kept out of the atmosphere for 100 years. Yet, this is not practical for soil carbon, which is considered as “short-lived” storage carrying a higher risk of reversal. In the USA, Nori manage permanence by offering short-term credits that expire after 10 years. In Europe, Soil Capital has a 5 year crediting period, in which farmers can earn and generate credits, followed by a 10 year retention period. Carbon Farmers of Australia must choose between 25 and 100 year permanence guarantee. - Additionality:

This is about whether the payment the farmer receives plays a decisive role in helping remove carbon from the atmosphere. Additionality is essential for the quality and credibility of the carbon offset market. Yet, especially in farming, its determination is subjective and deceptively difficult. Is this payment providing the make-or-break difference? - Measurement, verification and scope:

This is a complex area. For example, what’s included in the scope of the carbon footprint? Is the scheme considering the whole-farm’s carbon balance, or is it based on a per-hectare field basis? For example, in the USA, White Oak Pastures received scrutiny last year as their claims about having carbon negative beef neglected their wider, whole-farm footprint and landuse.

For measurement and verification, what protocols and tools are being used to measure and verify the sequestration? Is the payment based on actual field measurements (and if so, to what depth, to what lab test, resolution and frequency), or are they computer models of how carbon stocks are expected to change with different practices? How much of a buffer is in place for uncertainty? Can we trust those models, given how nascent our understanding is around soil carbon sequestration? Are they based on the UK context?

3) Demand transparency and having a choice in “the buyer“

It’s a common principle that organisations seeking to offset through farm and soil carbon should prioritise cutting their own emissions: minimising the need for offsets in the first place. As outlined in the Oxford Offsetting Principles, buyers of offsets should also publicly disclose their current emissions, accounting practices, reduction strategies and targets to reach net zero.

Furthermore, for the sake of the seller’s reputation, we believe farmers and landowners should also have some say or agreement to who’s buying the carbon offset. We believe geographically local carbon offsets are preferable, as it further assists with transparency and can provide an opportunity for the wider public to understand offsetting.

What next?

We are keen that farmers are incentivised and rewarded for farming sustainably. This may include payments for carbon reduction, building soil health and increasing sequestration. To this end, we’re aware our Farm Carbon Calculator is beginning to be used as a helpful tool to help guide such payments.

We will continue to draw on our practical, on-the-ground experience and expertise to contribute to projects in this space – always keen to support and advocate for robust and credible projects, schemes and marketplaces. Looking ahead, we have various innovations and services in the pipeline to support better, more accurate and meaningful carbon assessment. We’re also keen to continue contributing to the science and understanding of GHG emissions in agriculture. There’s lots to crack on with!

Useful further reading

- The Taskforce on Scaling Voluntary Carbon Markets: a private sector-led initiative working to scale an effective and efficient voluntary carbon market

- Offset Guide: a guide for organisations seeking to understand carbon offsets.

- The Oxford Principles for Net Zero Aligned Carbon Offsetting.

- Broekhoff, D., Gillenwater, M., Colbert-Sangree, T. & Cage, P. Securing Climate Benefit : A Guide to Using Carbon Offsets. 59 (2019).

- 10 myths about net zero targets and carbon offsetting: signed by 41 scientists

Recent Comments